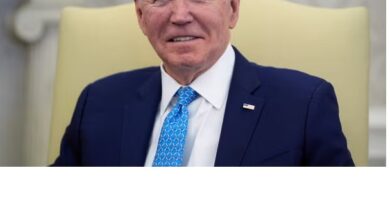

Joseph Biden pledged during his presidential campaign to make Saudi Arabia an international pariah. Then followed skyrocketing inflation and a conflict. Biden suppressed his remarks and travelled to Jeddah in July to meet with Crown Prince Mohammed bin Salman.

But if Biden had anticipated that MBS, as the Saudi monarch is known, would increase oil production at a time when higher crude prices were driving up inflation, he was in for a harsh awakening.

Instead, in October, the coalition of oil-producing nations commanded by Saudi Arabia reduced output by two million barrels per day to increase prices. Now, oblivious to a furious US president who has threatened unspecified “consequences,” it is once again curtailing production.

Vladimir Putin is likely to be one of the greatest beneficiaries as Joe Biden watches helplessly.

On Sunday, nine members of OPEC + (a larger group of 23 nations) announced a voluntary output limit of 1.2 million barrels per day from the month of May through the end of the year. This represents 1.1% of the global supply.

The action promptly increased oil prices, and they will continue to rise. Brent crude oil rose approximately 6% to over $85 per barrel. Goldman Sachs has increased its Brent crude price forecast for December 2023 from $US90 to $US95. By December of 2024, prices will reach $100 USD.

According to Bjarne Schieldrop, principal commodity analyst at SEB financial services, these prices will become the new norm. And it will materialise into suffering for millions of consumers in the form of higher petrol prices and higher prices in stores. The West is struck in three ways. The price of oil will maintain inflation elevated. The move indicates that Saudi Arabia is abandoning the West and embracing China. Increasing oil prices will weaken sanctions against Russia, where crude profits are about to increase.

According to Benjamin Hilgenstock, author of a report on Russian sanctions for the Centre for Economic Policy Research, every $1 increase in the price of petroleum oil increases Russian export revenues by about $US2.7 billion per year.

This year, a $10 increase in the price of oil will increase Russian crude export revenues by approximately $US27 billion, to $US145 billion. This is approximately 22.5 percent more than what CEPR had predicted prior to the OPEC decision.

The West’s sanctions on Russian oil arrived tardily. The EU did not impose an embargo on hydrocarbons until December 2022 and on petroleum products until February 2023. Russia benefited from high oil prices for the majority of last year, and its current account surplus reached a record high, according to Hilgenstock. Just as revenues were beginning to experience pressure, OPEC stepped in with a stimulus.

Oil’s rollercoaster ride

This is Saudi Arabia telling Russia, ‘Look, you’re our ally.’ They are taking sides with Russia and the Chinese alliance, according to Schieldrop.

“After OPEC’s reductions, the market will become tighter. Russia will be able to charge a higher price for energy, earn more money, and be better able to finance the conflict in Ukraine, which will indirectly counteract the sanctions imposed by the West.

The decision is natural for Saudi Arabia, as the preponderance of future oil demand will originate in Asia.

If they want to use shipping and transportation services from the OECD alliance of wealthy nations and the EU, they must be able to purchase from Russia as long as the petroleum price is below a ceiling. However, restrictions do not apply to nations such as China if they have no need for these services.

Rising oil prices will help boost Russia’s coffers.

Since the beginning of the conflict, Russian hydrocarbon exports to China, India, and Turkey have increased. According to CEPR, December 2022 exports were greater than December 2021 exports.

As Russia amasses wealth, the West will groan under the weight of inflation.

It is comparable to a tax on the global economy. It functions similarly to rate increases in that it has a decelerating effect, according to Schieldrop.

Since oil prices were so high last year, it is unlikely that headline inflation will rise, but the OPEC cut means prices will remain elevated for longer.

It demonstrates OPEC’s willingness and capacity to control prices. According to Ole Hansen, director of Commodity Strategy at Saxo Bank, this means that in the event of an economic decline, where reduced input prices could have mitigated some of the weakness, this will not occur.

Oil-dependent markets will experience price increases. “When it comes to sectoral sensitivity, the transportation industry will undoubtedly be the first to be targeted,” says Tamara Basic Vasilijev, senior economist at Oxford Economics.

According to Hansen, the cost of operating farm machinery will also increase, exerting additional pressure on food prices.

Since Friday, soybean and maize values have increased, he says.

The decision is a significant power play by Saudi Arabia, which has announced limits shortly after the United States announced that it would not increase global demand by restocking strategic reserves this year.

“This is Saudi Arabia saying, ‘Hey, Russia – you’re our friend.’ What they are doing here is siding with Russia and the Chinese alliance.”

The United States and Saudi Arabia have historically maintained close ties. Saudi Arabia is America’s greatest foreign customer for military purchases. James Swanston, economist for the Middle East and North Africa at Capital Economics, asserts that relations reached their zenith when Donald Trump was president. Trump adopted a hard stance against Iran. Relations have deteriorated under President Joseph Biden, who ran on an anti-Saudi platform.

“Almost on a personal level, Crown Prince Mohammed bin Salman took offence to the fact that President Biden preferred to speak directly with King Salman as opposed to MBS,” explains Swanston.

The action by OPEC capitalises on the fact that US shale production is approaching its zenith, after a lengthy period in which drilling in the country drove down prices.

Since early December 2022, the decline in unconventional oil production in the United States is essentially a blank check for OPEC plus.