The year 2022 is likely to go down as one of the worst years in history. This is because a series of shocking events caused the crypto space to crash hard. As most people in the market didn’t know what the next trend would be, the crypto markets were heavily affected by things like the US CPI rate, inflation rates, interest rates, etc. The recent problems in the US banking system were also good for the price of Bitcoin.

The price of Bitcoin went up a lot while the prices of other altcoins didn’t change much. This shows that traders are shifting their attention from other altcoins to Bitcoin. From just $15 billion in January to as much as $55 billion in March, the number of trades went through the roof. Since the bullish momentum seems to have picked up, this means that the price is likely to keep going up.

Bitcoin Technical Analysis

Short-Term Price Analysis of Bitcoin

- The Bitcoin price seems to be extremely positive in the short term as it is trading above an ascending trend line.

- The price is now trading along the trend line from early trading hours, indicating a challenging accumulation that may be followed by a positive breakout.

- Nevertheless, volatility has decreased significantly since volume has decreased since the previous trading day, which may slow the speed of the rise.

- Which is why, the price looks to be in a key phase in which a breakout may lead to the price approaching the resistance zone above $28,500, while a breakdown might drag the price close to $26,000.

Long-Term Bitcoin Price Analysis

- Bitcoin’s long-term price trend is positive, with the prospect of a bullish breakthrough occurring shortly.

- The price is stabilising around the gains and is expected to test the intermediate support at $26,975 before launching a new bullish wave.

- If the price does not recover, it may fall hard to the bottom support zone between $24,300 and $24,800.

- However, a solid comeback might push the price up to the trend line, which is now trading very close to $30,000.

Technical Analysis of the Bitcoin Price

| Indicators | Value (4hr / 1D) | Action (4hr /1D) |

| Relative Strength Index(RSI) | 43.45 / 62.54 | Neutral / Neutral |

| MACD | 3.10 / 1364.53 | Sell / Buy |

| Average Directional Index (ADX) | 20.71 / 36.35 | Neutral / Neutral |

| Average True Range (ATR) |

| Pivotal Levels | Value (4hr /1D) |

| Resistance | $30,304.2 / $31,045.41 |

| Support | $23,727.8 / $25,800 |

| Moving Average (MA)-50 | $27,664.35 / $23,832.16 |

| Moving Average (MA)-200 | $24,171.25 / $20,136.75 |

Overview of Bitcoin On-Chain

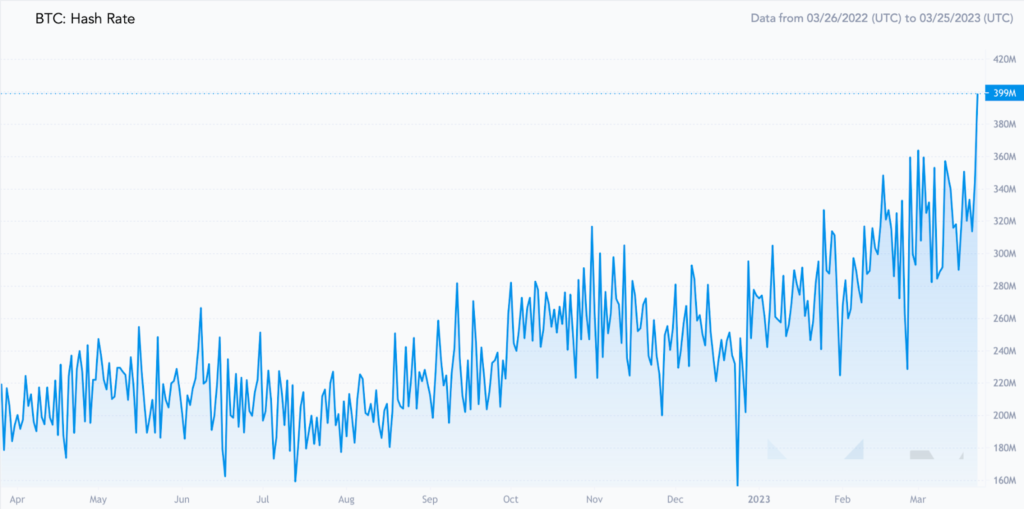

Bitcoin Hash Rate

The computational power required to validate the transaction and add the block to the blockchain is represented by the hash rate. It is measured in transactions per second (TH/s). The increase in hash rate indicates the participation of more miners, which raises the difficulty and reduces the possibility of a 51% attack because the nodes remain distributed, preserving blockchain’s core feature of remaining decentralised. Now, the hash rate has risen to a new peak of roughly 399 TH/s.

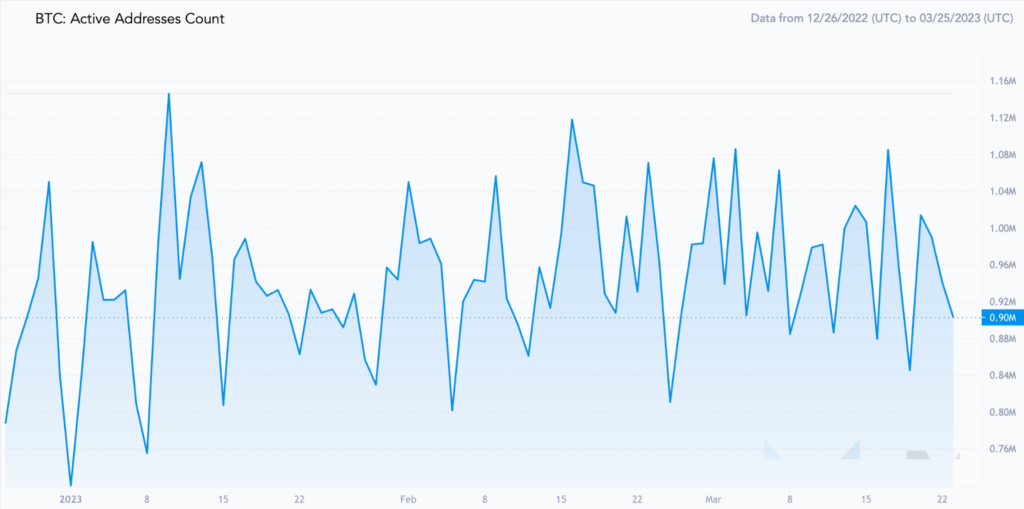

Bitcoin Active Addresses

The platform’s demand is determined by user activity on the platform. As a result, the number of active addresses interacting with the platform in a day is used to measure user activity on the platform. The daily active address count includes all addresses, regardless of whether they are buy, sell, or exchange addresses. The increase in active addresses raises volatility, which has a favourable influence on the price.

Bitcoin Supply on the Exchanges

The supply on the exchanges represents the total quantity of BTC in the reserves of all the exchanges. The increase in supply is typically regarded as a negative indication since traders transfer their holdings from their wallets to exchanges with the goal of selling or exchanging them for another coin. With a rise in the liquidity of the token on the platform, demand diminishes, and the price may fall due to the coiling selling volume.

Conclusion

Bitcoin price looks to be positive in the short and long term, prepared to breach the intermediate barrier of $30,000 at any time. Yet, the increase in exchange supply may be cause for concern, while increased activity is expected to maintain the positive momentum. As a result, the Bitcoin (BTC) price is about to embark on a new bullish wave that might push the price beyond $32,000 in the first half of 2023.